Actions Take by the Federal Government

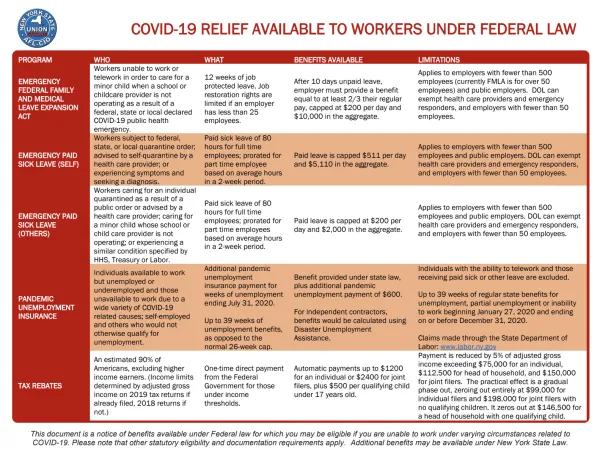

“Will help the United States combat COVID-19 by giving all American businesses with fewer than 500 employees funds to provide employees with paid leave or expanded family and medical leave, either for the employee’s own health needs or to care for family members.”

The FFCRA’s paid leave provisions are effective on April 1, 2020, and apply to leave taken between April 1, 2020, and December 31, 2020. The provisions will last through December 31, 2020.

Employees of covered employers are eligible for:

- Two weeks (up to 80 hours) of paid sick leave at the employee’s regular rate of pay because the employee is quarantined, and/or experiencing COVID-19 symptoms

- Two weeks (up to 80 hours) of paid sick leave at two-thirds the employee’s regular rate of pay because the employee is unable to work because of a need to care for an individual subject to quarantine, or to care for a child (under 18 years of age) whose school or childcare provider is closed or unavailable due to COVID-19

- Up to an additional 10 weeks of paid expanded family and medical leave at two-thirds the employee’s regular rate of pay where an employee, who has been employed for at least 30 calendar days, is unable to work due to need to care for a child who school or childcare provider is closed or unavailable due to COVID-19

Who is covered?

Private employers with fewer thant 500 employees and certain public employers.

Small businesses with fewer than 50 employees may qualify for exemption from the requirement to provide leave due to school closings or child care unavailability if the leave requirements would jeopardize the viability of the business as a going concern

“All employees of covered employers are eligible for two weeks of paid sick time for specified reasons related to COVID-19. Employees employed for at least 30 days are eligible for up to an additional 10 weeks of paid family leave to care for a child under certain circumstances related to COVID-19

Qualifying Reasons for Leave:

- is subject to a Federal, State, or local quarantine or isolation;

- has been advised by a healthcare provider to self-quarantine related to COVID-19;

- is experiencinng COVID-19 symptoms and is seeking a medeical diagnosis;

- is caring for an invidual subject to an order described in (1) or self-quarantine as described in (2);

- is caring for a child whose school or place of care is closed (or child care provider is unavaliable) for reasons related to COVID-19; or

- is experiencing any other substantially-similar condition specificed by the Secretary of Health and Human Services, in consulation with teh Secretaries of Labor and Treasury.

For reasons (1)-(4) and (6): A full-time employee is eligible for 80 hours of leave, and a part-time employee is eligible for the number of hours of leave that the employee works on average over a two-week period.

For reason (5): A full-time employee is eligible for up to 12 weeks of leave (two weeks of paid sick leave followed by up to 10 weeks of paid expanded family & medical leave) at 40 hours a week, and a part-time employee is eligible for leave for the number of hours that the employee is normally scheduled to work over that period.

Questions

How do I count hours worked by a part-time employee for purposes of paid sick leave or expanded family and medical leave?

- A part-time employee is entitled to leave for his or her average number of work hours in a two-week period. Therefore, you calculate hours of leave based on the number of hours the employee is normally scheduled to work.

When calculating pay due to employees, must overtime hours be included?

Yes. The Emergency Family and Medical Leave Expansion Act requires you to pay an employee for hours the employee would have been normally scheduled to work even if that is more than 40 hours in a week. However, the Emergency Paid Sick Leave Act requires that paid sick leave be paid only up to 80 hours over a two-week period.

What is my regular rate of pay for purposes of the FFCRA?

For purposes of the FFCRA, the regular rate of pay used to calculate your paid leave is the average of your regular rate over a period of up to six months prior to the date on which you take leave.[2] If you have not worked for your current employer for six months, the regular rate used to calculate your paid leave is the average of your regular rate of pay for each week you have worked for your current employer.

If you are paid with commissions, tips, or piece rates, these amounts will be incorporated into the above calculation to the same extent they are included in the calculation of the regular rate under the FLSA.

If I am home with my child because his or her school or place of care is closed, or child care provider is unavailable, do I get paid sick leave, expanded family and medical leave, or both—how do they interact?

- You may be eligible for both types of leave, but only for a total of twelve weeks of paid leave. You may take both paid sick leave and expanded family and medical leave to care for your child whose school or place of care is closed, or child care provider is unavailable, due to COVID-19 related reasons. The Emergency Paid Sick Leave Act provides for an initial two weeks of paid leave. This period thus covers the first ten workdays of expanded family and medical leave, which are otherwise unpaid under the Emergency and Family Medical Leave Expansion Act unless you elect to use existing vacation, personal, or medical or sick leave under your employer’s policy. After the first ten work days have elapsed, you will receive 2/3 of your regular rate of pay for the hours you would have been scheduled to work in the subsequent ten weeks under the Emergency and Family Medical Leave Expansion Act.

What records do I need to keep when my employee takes paid sick leave or expanded family and medical leave?

- Private sector employers that provide paid sick leave and expanded family and medical leave required by the FFCRA are eligible for reimbursement of the costs of that leave through refundable tax credits. If you intend to claim a tax credit under the FFCRA for your payment of the sick leave or expanded family and medical leave wages, you should retain appropriate documentation in your records. You should consult Internal Revenue Service (IRS) applicable forms, instructions, and information for the procedures that must be followed to claim a tax credit, including any needed substantiation to be retained to support the credit. You are not required to provide leave if materials sufficient to support the applicable tax credit have not been provided.

What documents do I need to give my employer to get paid sick leave or expanded family and medical leave?

You must provide to your employer documentation in support of your paid sick leave as specified in applicable IRS forms, instructions, and information.

Your employer may also require you to provide additional in support of your expanded family and medical leave taken to care for your child whose school or place of care is closed, or child care provider is unavailable, due to COVID-19-related reasons

If my employer closed my worksite before April 1, 2020 (the effective date of the FFCRA), can I still get paid sick leave or expanded family and medical leave?

No. If, prior to the FFCRA’s effective date, your employer sent you home and stops paying you because it does not have work for you to do, you will not get paid sick leave or expanded family and medical leave but you may be eligible for unemployment insurance benefits. This is true whether your employer closes your worksite for lack of business or because it is required to close pursuant to a Federal, State, or local directive. You should contact your State workforce agency or State unemployment insurance office for specific questions about your eligibility. For additional information, please refer to https://www.careeronestop.org/LocalHelp/service-locator.aspx

Unemployment Insurance Flexibility

Federal law allows state to pay benefits where:

- An employer temporarily ceases operations due to COVID-19, preventing employees from coming to work;

- An individual is quaranteind with the expectation of returning to work after the quarantine is over; or

- An individual leave employment due to a risk of exposure or infection or to care for a family member.

In addition, federal law does not requirean employee to quite in order to recieve benefits due to the impact of COVID-19.

Employee's Compensation

If a COVID-19 claim is filed by a person in high-risk employment, the Office of Workers' Compensation Programs (OWCP) DFEC will accept that the exposure to COVID-19 was proximately caused by the nature of the employment. If the employer supports the claim and that the exposure occurred, and the CA-1 is filed within 30 days, the employee is eligible to receive Continuation of Pay for up to 45 days.

A COVID-19 claim is filed by a person whose position is not considered high-risk, OWCP DFEC will require the claimant to provide a factual statement and any available evidence concerning exposure. The employing agency will also be expected to provide OWCP DFEC with any information they have regarding the alleged exposure, and to indicate whether they are supporting or controverting the claim. If the employer supports the claim and that the exposure occurred, and the CA-1 is filed within 30 days, the employee is eligible to receive Continuation of Pay for up to 45 days.Exposure – Federal employees who are required to interact with the public or front-line medical and public health personnel are considered to be in high-risk employmentExposure – Federal employees who are required to interact with the public or front-line medical and public health personnel are considered to be in high-risk employment

- Exposure – Federal employees who are required to interact with the public or front-line medical and public health personnel are considered to be in high-risk employment

- Medical – You will need to provide medical evidence establishing a diagnosis of COVID-19. You will also need to provide medical evidence establishing that the diagnosed COVID-19 was aggravated, accelerated, precipitated, or directly caused by your work-related activities. Please submit the results of any COVID-19 testing, if available. If you have encountered difficulty in obtaining such testing, OWCP will authorize such testing if you are working in high-risk employment or otherwise have a confirmed COVID-19 employment exposure.

Individuals

Most indivdual earning less than $75,000 can expect a one-time cash payment of $1,200. Married couples would each receive a check and families would get $500 per child. That means a family of four earning less than $150,000 can expect $3,400.

- No money for people making more than 99,000 and couples making more than 198,000

- Cash payments are based on either 2018 or 2019 tax filings.

- This law addes $600 per week from the federal government on top of whatever based amount a worker recieives from the state and will last for four months.

Employers can provide up to $5,250 in tax-free student loan repayment benefits. That means an employer could contribute to loan payments and workers wouldn't have to include that money as income

The bill requires all private insurance plans to cover COVID-19 treatments and vaccine and makes all coronavirus tests free.

The law also extends the tax filing deadlines to July 15.

Small Businesses

There are three main grants that the CARES Act funds. They are listed below:

- $10 billion for grants of up to $10,000 to provide emergency funds for small businesses to cover immediate operating costs

- $350 billion allocated for the Small Business Administration to provide loans of up to $10 million per business. Any portion of that loan used to maintain payroll, keep workers on the books or pay for rent, mortgage and existing debt could be forgiven, provided workers stay employed through the end of June.

- $17 billion to cover six months of payments for small businesses already using SBA loans.

Public Health

There are five main segments of funding for public health. THey are listed below.

- $100 billion for hospitals responding to the coronavirus

- $1.32 billion in immediate additional funding for community centers that provide health care services for roughly 28 million people

- $11 billion for diagnostics, treatments and vaccines. The bill also includes $80 million for the Food and Drug Administration to prioritize and expedite approval of new drugs

- $16 billion to the Strategic National Stockpile to increase availability of equipment, including ventilators and masks. It also boosts hiring for vital health care jobs during the public health crisis and speeds the development of a vaccine, treatments and faster diagnostic

- $20 billion set aside for veterans

State and Local Governments

There are two main parts of funding. They are listed below:

- $339.8 billion for programs that will go to state and local governments. It is divided up to put $274 billion toward specific COVID-19 response efforts, including $150 billion in direct aid for those state and local governments running out of cash because of a high number of cases.

- $5 billion for Community Development Block Grants, $13 billion for K-12 schools, $14 billion for higher education and $5.3 billion for programs for children and families, including immediate assistance to child care centers.